Jump Start Your Retirement Plans

Step 1: Imagine your retirement

Step 2: Know where you stand

Step 3: Learn the basics

Step 4: Decide on a solution

Step 5: Talk to a financial professional

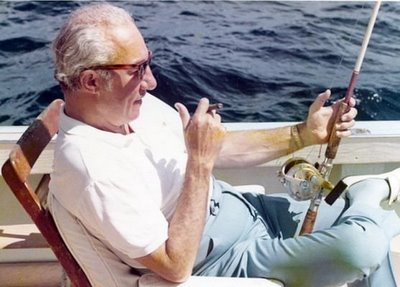

Are your pleasant daydreams about retirement ever harpooned by this panicky thought: What if I outlive my money? Well, don't sweat it. The most important element of investing — time — is something you still have. Here are five steps to making those panicky thoughts about retirement go away.

Step 1: Imagine your retirement Do you want to maintain your current life-style? A little simpler? A lot more grand? When you have a clear picture in your head about how you want your retirement to be, imagine the price tag attached to it. The Surprising Cost of Leisure ActivitiesWhat's the price tag on having fun in your retirement?What will my expenses be after I retire?

Step 2: Know where you standNow that you have an idea of what your expenses will be, you may be wondering how to know if you’ll have enough money to cover those expenses. Plan a Saturday afternoon where you can do what you have to do — get all the pertinent information together. Start with what you have now. Are your current savings invested properly, given the amount of time you have before retirement? Your Retirement Income Sources How Long Will My Money Last? Closing the Retirement Income "Gap" Am I saving enough? What can I change?

Step 3: Learn the basicsYou might know about mutual funds, but do you know how annuities work? What other retirement solutions are available to you? For instance, if your company matches your 401(k) contributions, what’s that worth to your retirement income? Understanding all your options can help you make the best choices.A Quick Guide to Investing Fundamentals The Advantages of Early-Start Investing Late-Start Investing: How to Catch Up

Step 4: Decide on a solutionNow it's time to fix your sights on your future savings. It doesn't matter how much or little you have to work with — what matters is that you get started now. Coming Up With the Cash to Invest Start Investing

Step 5: Talk to a financial professional

Steps 2-4 become a whole lot easier when you've got a financial professional on your side. It will cost you is some time — but then, you already know you have that going for you.

By Allstate.com

http://www.allstate.com/Finance/RetirementPlanning