Question For Sean Toh? Investing In Index Fund?

Hi Sean,

Do you have experience putting your money in ETF(Exchange Traded Funds)? I was thinking of investing some money in index funds and/or EFT (local or US). Do you have any recommendations or views on that? What is your view with regards to today's investment market? Is it on the high side (highest STI(Strait Times Index of Singapore) or do you feel that there is still market for increment, i.e. STI(Strait Times Index of Singapore) to reach 3000??.

From

Wilvan Wee

Here Is The Answers Specially For Your Questions, Wilvan! Sincerely From Sean Toh.

Dear Wilvan,

I'm glad that you are asking questions because this is where your financial education begins. First, I would like to define for you what is the purpose of an index.

An Index is derived from a selected number of underlying assets.

These Indices may be formulated to reflect the general movement of the value of the underlying assets. The composition and weight-age of the underlying assets may be formulated to reflect the movement of the value of an industry, a country or any collection of a class of assets. Hence, STI ( The Strait Times Index of Singapore ) is composed of 50 Singapore Stocks from various sectors.

Second, let me define for you what is an ETF(Exchange Traded Funds)

Exchange Traded Funds are Collective Investment schemes. Collective investment schemes are ways of investing money with other people in order to participate in a wider range of investments. Collective investments schemes are usually referred to as Mutual Funds, Managed Funds or simply Funds. These funds account for a large portion of the trading on most stock exchanges.

While the structure of ETF's vary around the world, major common features include:

An exchange listing and ability to trade continually.

They are often index linked instead of being actively managed.

These qualities give ETF's some advantages over Mutual Funds. ETF's allow for a diversified portfolio at a low cost. They can be used in both long term buy and hold and for selling short and hedging strategies.

Typically ETF's replicate a stock market index, such as Standard and Poor's 500, or the Hang Seng index, or STI(Strait Times Index of Singapore). They may also contain stocks from a specific market sector such as energy, or a commodity such as gold. They often have amusing or catchy, upbeat names like, "Diamond" and "Spider". ETF's are most commonly found on the AME or American Stock Exchange but it is starting to emerge in the Singapore Stock Exchange too.

ETF's present an alternative to the traditional open ended Mutual Funds( Units Trust in Singapore ). The Open ended index funds are particularly good for this type of use.

Having defined for you the two terms. I like to tell you that even I do not know if the market is high or low but the market is actually a reflection of lots of contributing factors like economical performance of a country, the psychology of the investors in the markets, politics in the countries, current affairs around the world, geography in the regions, etc. If everything is well, investors has more confident with the markets. They will throw in more capital for investment to cause the index to rise. If the conditions warrant that investors dump their investments because of fears, they will sell their stocks or investment which can sometimes cause the market to crash when the index drop too fast that is beyond governor's control.

Four Step To Financial Freedom's Program

In my book - 'Fours Steps To Financial Freedom' which will be launched early Christmas 2006, I have a chapter which is Chapter 9 - Zero Financial Education explaining the theory of - The fundamentals of winning and losing money equilibrium equation. The whole market is about 'selling' and 'buying'. When to enter the market depends on a person's mix of characteristics which cause him to make a rational or irrational decision to invest. If his decision is irrational, he will enter the market buying at a high. If his decision is rational, he might not enter the market if he intends to buy at a low but master investor will see this an opportunities and start building their positions to short the market as it might start to crash rapidly. What I'm trying to tell you is that your financial education will guide you to make rational investment decisions whereas ignorance will cause you to lose money. Start your financial education now. Find the answers to those questions that are in your head and answer them everyday. When 3 years have passed, you will be more financially confident. I afraid I'm don't collect clients to help them invest but the advices that I'm giving will be at a neutral standing point to let you decide what to do next. You have to be responsible for your decisions not somebody else.

Most master investor has a system for investing that has been tested rigorously for successful profit reaping. Do you have one? You have to sit down to design and experiment with yours to see if yours could stand the test. How could I devise one? Sean, you must be joking! You will if you start your financial education. A system or technique to beat the market if the market is fluctuating used by novice, or even mature investors is called -

' The Dollars Cost Averaging '- A Technique that Drastically Reduces Market Risk.

Dollar cost averaging is a technique designed to reduce market risk through the systematic purchase of securities at predetermined intervals and set amounts. Many successful investors already practice without realizing it. Many others could save themselves a lot of time, effort and money by beginning a plan. You will learn the three steps to beginning a dollar cost averaging plan, look at concrete examples of how it can lower an investor’s cost basis, and discover how it reduces risk.

Dollars Cost Averaging: What is It?Instead of investing assets in a lump sum, the investor works his way into a position by slowly buying smaller amounts over a longer period of time.

This spreads the cost basis out over several years, providing insulation against changes in market price.

Setting Up Your Own Dollar Cost Averaging PlanIn order to begin a dollar cost averaging plan, you must do three things:

1. Decide exactly how much money you can invest each month. Make certain that you are financially capable of keeping the amount consistent; otherwise the plan will not be as effective.

2. Select an investment (index funds are particularly appropriate, but we will get to that in a moment) that you want to hold for the long term, preferably five to ten years or longer.

3. At regular intervals (weekly, monthly or quarterly works best), invest that money into the security you’ve chosen. If your broker offers it, set up an automatic withdrawal plan so the process becomes automated.

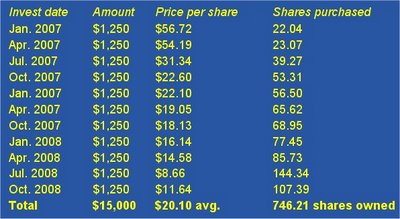

An Example of a Dollar Cost Averaging PlanYou have $15,000 you want to invest in XYZ common stock. The date is January 1, 2007. You have two options: you can invest the money as a lump sum now, walk away and forget about it, or you can set up a dollar cost averaging plan and ease your way into the stock. You opt for the latter and decide to invest $1,250 each quarter for three years. (See chart for math of dollar cost averaging plan.)

Had you invested your $15,000 in January 2007, you would have purchased 264.46 shares at $56.72 each. When the stock closed for the year in December of 2007 at $13.69, your holdings would only be worth $3,620!

Had you dollar cost averaged into the stock over the past three years, however, you would own 746.21 shares; at the closing price, this gives your holdings a market value of $10,216. Although still a loss, XYZ stock must only go up to $20.10 for you to break even, not $56.72, which would have been required without the dollar cost averaging.

To go a step further, without dollars cost averaging you would break even at $56.72. With dollar cost averaging, you would have turned a profit of $27,326 when the stock hit that price thanks to your lower cost basis ($56.72 sell price - $20.10 average cost basis = $36.62 profit x 746.21 shares = $27,326 total profit.)

Combining the Power of Dollar Cost Averaging with the Diversification of a Mutual FundIndex funds are passively managed mutual funds that are designed to mimic the returns of benchmarks such as the S&P 500, the Dow Jones Industrial Average, STI-ETF, etc. An investor that puts money into a fund designed to mimic the Wilshire 5000, for example, is literally going to own a fractional interest in every one of the five thousand stocks that make up that index. This instant diversification comes with the added bonus. Traditionally, management fees of passive funds are less than one-tenth those of their actively managed counterparts. Over the course of a decade, for example, this can add up to tens of thousands of dollars the investor would have paid in fees to the mutual fund company that, instead, are accruing to his or her benefit.

The dollar cost averaging component reduces market risk, while the index fund investment reduces company-specific risk. This combination can be among the best investment options for individuals looking to build up their long term wealth by having a portion of their portfolio in equities.

Table 1: XYZ with Dollars Cost Averaging

Well, I hope this education will allow you to decide what you should do next, Wilvan. That will be $200 dollars for this 2 hours of consultation because my rate is $100 per hours, Wilvan. I will charge you nothing as this is first consultation. For subsequent consultation, the rate will be $100 per hour....The best financial advisor that you could find is in front of your mirror at home.

Although I have recommended and advise you on lots of matters, it takes more than education, resources and advice for you to be successful. You need to be patience and committed to your plan to achieve a bit of success. It’s that bit of success that will motivate you even more to learn and apply what you learned in life for your future success. Just in case, if you have been waiting the whole day for all the answers. I will like to apologize for the delay to your answers because I believe in giving my best advice to you personally and sincerely from my heart. I needed the time to understand the problems you faced, understanding them and finding the right resources for your education so that you have a higher success rate when you implement your plan.

Last but not least, may I wish you all the success implementing the plan and achieving some results that you can see for yourself. Do consult a proper financial planner or advisor if you are really in doubts. It's you that make the decision to decide if you want to be successful? Enjoy creating wealth with health. It’s has been my pleasure providing consultancy service to you, Wilvan!

Your Sincerely

Sean Toh

P.S. If you find that Credit Plus Health By Sean Toh has empowered you to learn a lots more to take control of your financial & health matters, please share this website with the world, your friends and family members. Click here to Tell Your Friends Now!

P.P.S. Feel free to ask Sean Toh your single most important question about personal investing and health matters that will help you get started on this journey to create wealth for yourself? Ask Sean Toh Now!