The Top Ten In 2004

William Gates III

1

49 , self made Track This Person

Source: MicrosoftNet Worth: $46.5 bil Country of citizenship: United StatesResidence: Medina, WA, United States Industry: SoftwareMarital Status: married , 3 children Harvard University, Drop Out

Gates was given honorary knighthood in March, but don't call him Sir William: the title is only good for citizens of the Commonwealth. He is staying plenty busy pressing Microsoft beyond PCs into television set-top boxes, games, cell phones. "Software is where the action is," Gates proclaimed to company researchers last August. Competition from rival open source operating system, Linux, is stalling Microsoft's growth in the server market, but desktop dominance remains intact: Windows installed in 94% of PCs being sold. Next version, Longhorn, should be ready in 2006. Microsoft, meanwhile, is pursuing online music, photos and search software. Gates is methodically diversifying his wealth: He sells 20 million shares each quarter, reinvests through Cascade Investment in nontech companies, including big stakes in Cox Communications, Canadian National Railway, Republic Services. World's biggest philanthropist also devoting $27 billion to good deeds. Bill & Melinda Gates Foundation fights infectious diseases (hepatitis B, AIDS), funds vaccine development, helps high schools.

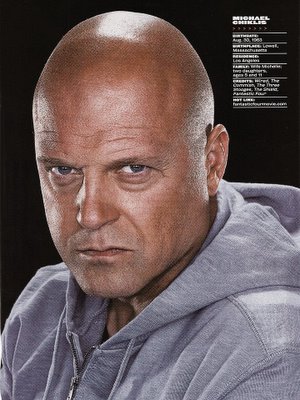

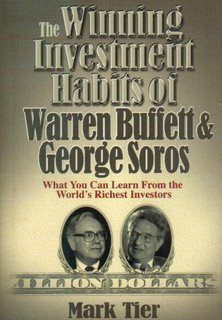

Warren Buffett

2

74 , self made Track This Person

Source: Berkshire HathawayNet Worth: $44 bil Country of citizenship: United StatesResidence: Omaha, NE, United States Industry: InvestmentsMarital Status: widowed , 3 children University of Nebraska Lincoln, Bachelor of Arts / ScienceColumbia University, Master of Science

Newspaper delivery boy filed first 1040 at age 13; claimed $35 deduction for bicycle. Studied under Benjamin Graham at Columbia. Applied value-investing principles to build Berkshire Hathaway to $133 billion (market cap) holding company: insurance, energy, carpets, jewelry, furniture, paint (Benjamin Moore), apparel (Fruit of the Loom). Also big stakes in American Express, Coca-Cola, Gillette (now set to merge with Procter & Gamble). Admits Berkshire's $30 billion-plus cash hoard is underutilized: "It's a painful condition to be in, but not as painful as doing something stupid—[Vice Chairman] Charlie [Munger] and I detest taking even small risks." Recent bets include Pier One Imports, Comcast, food distributor McLane. Bought mobile-home maker Clayton Homes after reading autobiography by company founder. "If we fail, we will have no excuses." Since taking control of Berkshire has delivered compound annual return of 24%. Outspoken opponent of Bush tax cuts, courted as adviser to pols Arnold Schwarzenegger and John Kerry. Critic of lax corporate governance, became target of failed campaign to vote him off Coca-Cola board. Fanatical supporters still far outnumber critics: Berkshire's folksy annual meeting crowds routinely top 15,000.

Lakshmi Mittal

3

54 , inherited and growing Track This Person

Source: steelNet Worth: $25 bil Country of citizenship: IndiaResidence: London, United Kingdom Industry: ManufacturingMarital Status: married , 2 children St Xavier's College Calcutta, Bachelor of Arts / Science

Coming-out year for the steel titan, who now oversees the world's largest steel company, Mittal Steel. In December he merged his Ispat International with Ohio-based International Steel Group. Owns 88% of the $31.5 billion (sales) company. Recently shelled out $100 million for a new 12-bedroom mansion in London's posh Kensington neighborhood. Also reportedly dropped $60 million to host his daughter's five-day-long wedding celebration in Versailles last summer.

Carlos Slim Helu

4

65 , inherited and growing Track This Person

Source: telecomNet Worth: $23.8 bil Country of citizenship: MexicoResidence: Mexico City, Mexico Industry: CommunicationsMarital Status: widowed , 6 children

Just call him Midas. Latin America's richest man upped his wealth this year by an incredible $10 billion, thanks to a growing and diverse empire that includes holdings in retail, banking and insurance, and auto parts manufacturing. Shares of his flagship wireless telecom outfit, América Movil, soared 76% during the year. And his fixed-line operator, Telefonos de Mexico, or Telmex, is reportedly gearing up to double its customer base this year, primarily in Mexico, by signing up 600,000 broadband Internet subscribers. As one of its largest shareholders, Slim was purportedly contemplating taking MCI private—until Verizon bid to acquire the beaten-down phone company in February. Said to have one of Latin America's largest collections of Rodin sculptures; is also the founder of Foundation of the Historic Center of Mexico City, dedicated to restoring colonial buildings in Mexico City's historic city center.

Prince Alwaleed Bin Talal Alsaud

5

48 , self made Track This Person

Source: investmentsNet Worth: $23.7 bil Country of citizenship: Saudi ArabiaResidence: Riyadh, Saudi Arabia Industry: InvestmentsMarital Status: married , 2 children Menlo College, Bachelor of Arts / ScienceSyracuse University, Master of Science

This savvy global investor and nephew of the Saudi king continues to thrive on deal-making—in addition to a dash of pro-American political crusading. His fortune, anchored by a $10 billion stake in Citigroup, was lifted in part by a 116% rise in the Saudi stock market in 2004. Last year he unloaded his half of New York's Plaza Hotel and plowed the profits into buying stakes in London's Savoy Hotel and Monaco's Monte Carlo Grand. In January he helped bail out an ailing Disneyland-Paris with a $30 million cash injection. A vocal supporter of women's rights, he hired the first female airplane pilot in Saudi Arabia, a country where women still can't legally drive. Clearly pleased with his stock picking prowess, he took out ads on CNN touting his holdings. "We're telling the market all these companies are number one in their field," crows Alwaleed.

Ingvar Kamprad

6

78 , self made Track This Person

Source: IkeaNet Worth: $23 bil Country of citizenship: SwedenResidence: Lausanne, Switzerland Industry: RetailingMarital Status: married , 4 children

Founder and owner of $16.4 billion (sales) IKEA, the preferred furniture company for the hip and cost-conscious. Cultlike following: store openings draw huge, occasionaly unruly crowds, sometimes resulting in stampedes or in one case two deaths. Stories of Kamprad parsimony abound: He reportedly flies economy, stays in cheap hotels and so on. But he doesn't deprive himself entirely: owns a posh villa in Sweden, a 17-hectare winery in Provence and lives in wealthy-friendly Switzerland rather than Sweden.

Paul Allen

7

52 , self made Track This Person

Source: Microsoft, investmentsNet Worth: $21 bil - Country of citizenship: United StatesResidence: Seattle, WA, United States Industry: SoftwareMarital Status: single Washington State University, Drop Out

Microsoft cofounder still a believer in "wired world," though these days jettisoning investments like TechTV in favor of biotech. Stock in cable company Charter Communications languishing, thanks to an assist from the indictment of 4 executives on charges of inflating company's results. Other misfortune with investment in troubled telecom provider RCN; last year he sold his stake at a big loss. Still managing to have a good time elsewhere. Owns pro football's Seattle Seahawks, basketball's Portland Trail Blazers. Financial backer of SpaceShipOne, first to launch private flight into suborbital space. Added Science Fiction Museum to his Experience Music Project in Seattle; includes captain's chair from the original Star Trek. Other captain's chair sits high atop the Octopus, 413-foot yacht armed with 2 helicopters and a 60-foot submarine. His Paul G. Allen Family Foundation has donated heavily to education, art and science causes. Joined buddy Bill Gates in 1975, left the company in 1983 to fight Hodgkin's disease. Has been slowly selling off Microsoft stake ever since.

Karl Albrecht

8

85 , self made

Source: supermarketsNet Worth: $18.5 bil Country of citizenship: GermanyResidence: Muehlheim an der Ruhr, Germany Industry: RetailingMarital Status: married , 2 children

Richest man in Germany. With younger brother, Theo, turned mother's corner grocery store into discount supermarket giant Aldi. Now has 7,000 stores and estimated $50 billion in sales. Karl used to manage more profitable southern half of Aldi's German business, but has since retired. Fiercely private, he apparently loves golf and raises orchids.

Lawrence Ellison

9

60 , self made Track This Person

Source: OracleNet Worth: $18.4 bil Country of citizenship: United StatesResidence: Silicon Valley, CA, United States Industry: SoftwareMarital Status: married , 2 children University of Illinois, Drop Out

Chicago native cofounded database software firm Oracle in 1977 and took it public in 1986, one day before Microsoft; nipping at rival's heels ever since. Touts Darwinian view of software industry, decreeing that all but the largest players are doomed. Just as competitive on the high seas: Ellison’s a tenacious competitor in the America's Cup and his BMW Oracle Racing team looks to be in fighting trim leading up to the 2007 race. A visionary very attached to his own vision of things, he gave exclusive access to a biographer in exchange for being allowed to pepper the book with footnotes giving his own version of events. Latest footnote: adding PeopleSoft to Oracle's arsenal.

S Robson Walton

10

61 , inherited Track This Person

Source: Wal-MartNet Worth: $18.3 bil Country of citizenship: United StatesResidence: Bentonville, AR, United States Industry: RetailingMarital Status: divorced , 3 children University of Arkansas, Bachelor of Arts / ScienceColumbia University, Doctor of Jurisprudence

Eldest son of Sam Walton (d. 1992), legendary merchant who opened first discount store in Rogers, Ark. in 1962. Took Wal-Mart public in 1970; explosive growth. Wal-Mart is now the world's largest retailer, with more than 5,000 stores. Serves as Wal-Mart chairman. Retail giant is now selling softer side after barrage of criticism over poor worker benefits and strong-arming suppliers. Family donates via Walton Family Foundation.

http://www.forbes.com/2005/03/09/bill05land.html