Ronnie Coleman Set New Standard For Mr Olympia

In 1996, Dorian Yates set a new standard for bodybuilding training videos with the release of his hard-core tape "Blood and Guts". It's only fitting that the video that raises that standard should come from Dorian's successor to the throne of Mr. Olympia, none other than Ronnie Coleman himself.

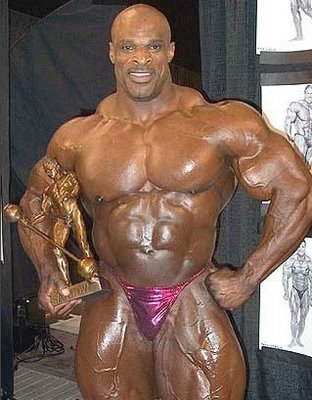

In "Ronnie Coleman - The Unbelievable", Mitsuru Okabe has collaborated with the 3 Time Mr. Olympia to create the most incredible display of brutal, hard-core training ever witnessed. After viewing the tape for the first time, I had to question if Coleman is even human because the workouts he performs only 5 weeks away from the 2000 Mr. Olympia contest are anything but.

Mike Quinn once commented that his competitors have to beat him in the gym first if they wanted to beat him on stage. If this is true, I can't imagine anyone beating Ronnie Coleman for a long, long time because I sincerely doubt if anyone is putting out the kind of intensity and effort that he is.

The video chronicles a week of Coleman's preparation for the Mr. Olympia contest. A true training tape, it includes four workout sessions that cover every bodypart. The video begins with a delts and trap training session. Ronnie states that his goal while training for the Mr. Olympia is to use the same poundages that he routinely uses in the off-season even though he is limiting the amount of calories and carbs that he normally takes in.

During his deltoid workout, Coleman easily performs Seated Military Presses with 315 pounds for 12 reps. After the basics are out of the way, Ronnie demonstrates his version of Giant Sets as he applies them to the Side Lateral Raise exercise. His incredible delts look like oversized coconuts as he pumps them up with set after set. The workout concludes with 200 pounds Dumbbell Shrugs as he trains those massive traps that threaten to reach up and touch his ears.

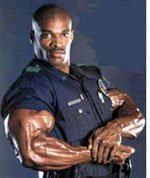

After the workout, we watch as Ronnie gets ready for work as a police officer with the Arlington, Texas police department. The sight of the 285 pound Mr. Olympia as he arrives at a domestic disturbance is hilarious. Having Ronnie arrive at your door has to be quite a sobering experience.

Coleman's dedication is evident as he works his training and diet around his work schedule. He is on the treadmill for an hour when he wakes up at 7am and then again when he gets home from a long day at work at midnight. In between, he can be seen eating his home-cooked chicken in the squad car as he attempts to get his meals in on time.

The second workout on the tape is an incredible back training session. Beginning with Deadlifts, Ronnie warms up with several sets before displaying world-class powerlifting strength as he pulls a gargantuan 805 pounds off the floor for 2 reps! Has this ever been done by a bodybuilder before, let alone 5 weeks out from a contest?? Barbell Rows with 495 pounds are performed next with relative ease considering they are done after the Deadlifts. Wait, he's not finished yet! Rows with the end of the barbell in the corner finish the workout. We watch in amazement as he rams up 12 plates (540 pounds)for an amazing 9 reps! Ronnie delivers the most quotable line in the video as he states, "Everybody want to be a bodybuilder but don't nobody want to lift no heavy ass weights!"

The next workout on the video is for chest and triceps. Everyone knows how strong Chris Cormier is in the gym. I recall watching the "Road to the Olympia 99" tape and being very impressed when Chris did 5 shaky reps with 200 pound dumbbells on the Dumbbell Bench Press exercise. You can imagine how amazed I was when Coleman manhandles the same weight for an easy 12 reps. I'm telling you, this guy is not human!

All of Coleman's workouts take place in the Metroplex Gym in his hometown. After seeing so many of bodybuilding's "superstars" with their support "teams" working out in some of the most glamorous gyms in the country, I was shocked to see Mr. Olympia himself training alone in a hard-core gym with NO support and NO help. Ronnie doesn't even have a training partner throughout the tape and he often has to call for gym owner Brian Dobson to come from behind the front desk to give him a spot. Of course, that doesn't stop him from performing some of the most mind-blowing workouts ever as he prepares to win another Olympia title.

The video concludes with a leg workout that has to be seen to be believed. A true proponent of basic exercises and heavy training, Ronnie demonstrates what intensity is all about as he begins with the Front Squat exercise. In what has to be some of the most incredible training footage ever filmed, Coleman pumps out reps in the Front Squat with 585 pounds! You will watch in amazement as the bar bends under the strain of the weight and Ronnie's head looks like it's going to pop off from the tension. After 4 reps, Ronnie drops the bar but comes back in the next set to pump out an easy 10 reps with a mere 495 pounds.

Super heavy Hack Squats are next and Ronnie wraps up the workout by doing Walking Barbell Lunges in the parking lot of the gym. Coleman looks like a modern-day Hercules as he toils under the hot summer sun walking the length of the parking lot with 185 pounds on his shoulders.

Even more amazing than Ronnie Coleman's strength and physique is his attitude and character. There is never a hint of self-pity or despair during this incredible display of superhuman workouts. Ronnie truly loves bodybuilding and I could not imagine him any happier than he is when he is lifting heavy weights and pumping up. Throughout the video, he routinely lets out exultations of "Light Weight!" and "Yeah buddy!" as he psychs up to lift these incredible poundages.

The video concludes with Ronnie's tribute to gym owner Brian Dobson. He touchingly refers to Dobson as his own personal "angel". Ronnie states that he believes everyone has a purpose in life and his purpose was to be Mr. Olympia. When Brian Dobson approached Ronnie in 1989 and offered him a free gym membership if he would enter a bodybuilding contest, he set into motion a series of events that have culminated with Ronnie Coleman as 3 time Mr. Olympia winner and one of the biggest and most intense bodybuilders on the planet. We should all be thankful!

This is what Ronnie Coleman himself had to say about my review of the video.

Wow John that was one incredible review, it brought tears to my eyes, I'm surely gonna frame it when it comes out in the Magazine. Thanks a whole lot bro, I really and truly do appreciate that you appreciate the hard work and dedication that went into making that video. I did have a lot of fun making it and now I know it was well worth it from that review.

By Ronnie Coleman

http://naturalolympia.com/html/ColemanVideoReview.html