Building That TricepsDumbbell Kickback IFBB pro Darrem Charles states: "I typically do my final exercise with lighter weight and super-strict form."

Beginning

SETUP: "To start, take a stable position so you can't swing the weight up. As with the pressdown, hold your upper arm adjacent to your body."

Execution

EXECUTION TIP: "Control the motion to ensure that your triceps do all the work, and take each set to failure. Once the muscle begins to fatigue, I'll continue with partial reps -- I don't stop until the muscle is completely depleted of strength and my triceps are on fire."

EXECUTION TIP: "Control the motion to ensure that your triceps do all the work, and take each set to failure. Once the muscle begins to fatigue, I'll continue with partial reps -- I don't stop until the muscle is completely depleted of strength and my triceps are on fire."

By Darrem Charles http://www.muscleandfitness.com/

Let's TalkFor any couple, communication is key to a healthy sex life. Unfortunately, shame and fear keep many women from speaking up. Partners need to talk about their sexual needs when they are both relaxed—not when they're under pressure. Discuss sexual issues outside of the bedroom, and stress the positives. Dr. Hutcherson RecommendsTo get what you want in bed, speak up!You can't expect your partner to intuitively know what gives you pleasure. Be specific in describing what feels good and what you'd like to try.Why not read a sexy book or watch an erotic video together? According to Dr. Hutcherson, it might ease communication and you might run across some new ideas to try together!By Dr. Hutcherson http://www.oprah.com/

Let's TalkFor any couple, communication is key to a healthy sex life. Unfortunately, shame and fear keep many women from speaking up. Partners need to talk about their sexual needs when they are both relaxed—not when they're under pressure. Discuss sexual issues outside of the bedroom, and stress the positives. Dr. Hutcherson RecommendsTo get what you want in bed, speak up!You can't expect your partner to intuitively know what gives you pleasure. Be specific in describing what feels good and what you'd like to try.Why not read a sexy book or watch an erotic video together? According to Dr. Hutcherson, it might ease communication and you might run across some new ideas to try together!By Dr. Hutcherson http://www.oprah.com/

Insurance Can Be Difficult To UnderstandAs recent natural disasters have taught us, we all need to give our insurance policies a checkup: If you're in a flood zone or an area susceptible to hurricanes and strong storms, you need flood insurance: Damage from rising water isn't covered in standard policies. Ask your agent to help, and look into the federal policy offered by FEMA (www.floodsmart.gov). If you want your flood insurance to cover the contents of your home, you'll have to pay a higher premium. It's worth it.Understand your replacement coverage. Make sure you know what it would really cost if you needed to buy or build a comparable home, given today's costs, and adjust your policy accordingly. Ask what you'd be paid if you decided to move to a different location. Your possessions should also be insured for replacement cost. "Actual value" coverage might leave you dangerously underinsured; you'd be paid only the depreciated value of your lost items. If you find yourself at odds with your insurer, don't give up. Ask for a detailed, written account of why your claim was denied, and challenge those findings. If that doesn't work, contact your state insurance department (look on www.naic.org) and file a complaint. For a loss resulting from a massive disaster, find others who were denied claims from your carrier and fight together—there's power in numbers. By Suze Ormanhttp://www.oprah.com/omagazine/

Insurance Can Be Difficult To UnderstandAs recent natural disasters have taught us, we all need to give our insurance policies a checkup: If you're in a flood zone or an area susceptible to hurricanes and strong storms, you need flood insurance: Damage from rising water isn't covered in standard policies. Ask your agent to help, and look into the federal policy offered by FEMA (www.floodsmart.gov). If you want your flood insurance to cover the contents of your home, you'll have to pay a higher premium. It's worth it.Understand your replacement coverage. Make sure you know what it would really cost if you needed to buy or build a comparable home, given today's costs, and adjust your policy accordingly. Ask what you'd be paid if you decided to move to a different location. Your possessions should also be insured for replacement cost. "Actual value" coverage might leave you dangerously underinsured; you'd be paid only the depreciated value of your lost items. If you find yourself at odds with your insurer, don't give up. Ask for a detailed, written account of why your claim was denied, and challenge those findings. If that doesn't work, contact your state insurance department (look on www.naic.org) and file a complaint. For a loss resulting from a massive disaster, find others who were denied claims from your carrier and fight together—there's power in numbers. By Suze Ormanhttp://www.oprah.com/omagazine/

Why you should be taking Omega-3 fish oils every dayYou and your family need more than a Multivitamin. Independent research is demonstrating time and time again the value of essential fatty acids found in omega-3 fish oils. The Eskimo product range has been meticulously researched and formulated to provide you with incredibly pure omega-3 fish oils to support you and your family's health requirements.There is something about the EskimosIt started over 20 years ago when 2 physicians visited Greenland to observe the Eskimos. They noticed that although Eskimos consume large amounts of fat, they avoid many of the conditions associated with a high fat diet. This was thought to be because they consumed large amounts of omega-3 EPA and DHA fatty acids. Having published over 400 papers, mainly in cardiovascular medicine, Professor Tom Saldeen decided to undertake further research into the revolutionary ideas. He concluded that these fatty acids are indeed highly beneficial to health but are often significantly lacking from the western diet. Pure, stable fish oilsThe doctors went on to research a way of presenting a fish oil which was pure from harmful toxins and heavy metals and one which did not go rancid on exposure to oxygen. Eskimo-3 is one of the purest, most stable fish oils on the market.From toddlers to teens can benefit from using fish oil as a daily supplementFish oil provides valuable omega-3 fatty acids EPA &DHA, which are often lacking in those who rarely eat fish. Fish oil plays a significant role in supporting the cardiovascular system because of its effect on blood pressure, lipoproteins, cholesterol, prostaglandins and fibrinogen. People who consume large amounts of fish or fish oil have a decreased risk of developing cardiovascular conditions. Omega-3 fatty acids help to keep the skin supple and elastic. Fish oil has been well researched for its role in helping to support healthy joints.

Why you should be taking Omega-3 fish oils every dayYou and your family need more than a Multivitamin. Independent research is demonstrating time and time again the value of essential fatty acids found in omega-3 fish oils. The Eskimo product range has been meticulously researched and formulated to provide you with incredibly pure omega-3 fish oils to support you and your family's health requirements.There is something about the EskimosIt started over 20 years ago when 2 physicians visited Greenland to observe the Eskimos. They noticed that although Eskimos consume large amounts of fat, they avoid many of the conditions associated with a high fat diet. This was thought to be because they consumed large amounts of omega-3 EPA and DHA fatty acids. Having published over 400 papers, mainly in cardiovascular medicine, Professor Tom Saldeen decided to undertake further research into the revolutionary ideas. He concluded that these fatty acids are indeed highly beneficial to health but are often significantly lacking from the western diet. Pure, stable fish oilsThe doctors went on to research a way of presenting a fish oil which was pure from harmful toxins and heavy metals and one which did not go rancid on exposure to oxygen. Eskimo-3 is one of the purest, most stable fish oils on the market.From toddlers to teens can benefit from using fish oil as a daily supplementFish oil provides valuable omega-3 fatty acids EPA &DHA, which are often lacking in those who rarely eat fish. Fish oil plays a significant role in supporting the cardiovascular system because of its effect on blood pressure, lipoproteins, cholesterol, prostaglandins and fibrinogen. People who consume large amounts of fish or fish oil have a decreased risk of developing cardiovascular conditions. Omega-3 fatty acids help to keep the skin supple and elastic. Fish oil has been well researched for its role in helping to support healthy joints.

Over 60% of the brain is made from fat!

By goodnessdirect.co.ukhttp://www.goodnessdirect.co.uk/cgi-local/frameset/article/65.html

How Harmful Is Secondhand Smoke?Secondhand smoke is other people's tobacco smoke. Also known as passive smoking, secondhand smoke is a major source of indoor air pollution. It can lead to heart disease and lung cancer, and make illnesses like asthma worse. Secondhand smoke is made of two types of smoke: Mainstream smoke - is smoke breathed in and out by smokers Sidestream smoke - comes from the end of a burning cigarette or cigar, and makes up 85 per cent of the smoke in a smoky environment. This type of smoke contains more toxins and nicotine than mainstream smoke. Short-term effectsThe effects you might notice straight away include: Coughing Headache Eye irritation Sore throat Sneezing and runny nose Feeling sick Breathing problems (and possibly an asthma attack) Irregular heartbeat (a particular problem for people with heart disease) Long-term effectsWorsening of chest problems and allergies like asthma, hay fever, bronchitis and emphysema Increased risk of heart disease Increased risk of lung cancer Pregnant women exposed to secondhand smoke can pass on the harmful gases and chemicals to their babies By givingupsmoking.co.ukhttp://www.givingupsmoking.co.uk/shsmoke/whatis/

How Harmful Is Secondhand Smoke?Secondhand smoke is other people's tobacco smoke. Also known as passive smoking, secondhand smoke is a major source of indoor air pollution. It can lead to heart disease and lung cancer, and make illnesses like asthma worse. Secondhand smoke is made of two types of smoke: Mainstream smoke - is smoke breathed in and out by smokers Sidestream smoke - comes from the end of a burning cigarette or cigar, and makes up 85 per cent of the smoke in a smoky environment. This type of smoke contains more toxins and nicotine than mainstream smoke. Short-term effectsThe effects you might notice straight away include: Coughing Headache Eye irritation Sore throat Sneezing and runny nose Feeling sick Breathing problems (and possibly an asthma attack) Irregular heartbeat (a particular problem for people with heart disease) Long-term effectsWorsening of chest problems and allergies like asthma, hay fever, bronchitis and emphysema Increased risk of heart disease Increased risk of lung cancer Pregnant women exposed to secondhand smoke can pass on the harmful gases and chemicals to their babies By givingupsmoking.co.ukhttp://www.givingupsmoking.co.uk/shsmoke/whatis/

What are the benefits of cycling?

What are the benefits of cycling?

Cycling on a regular basis :reduces the cholesterol levels in the blood. increases the high density lipo-protein/cholesterol ratio in the blood as well. reduces the chances of strokes and heart attacks caused by clotting. reduces the chances of illnesses caused by high blood pressure. is as effective as drugs in reducing high blood pressure. makes obesity unlikely thus helping reduce the chances of diabetes. Why is cycling a better exercise than walking? Walking provides less exercise for the heart. In a Finnish study of men and women who had freely chosen their own method of exercise, walkers reached 60% of their maximum heart rate, and cyclists reached 70% of theirs. As a result, the cyclists' bodies improved more: the walkers averaged a VO2 max of 38 while the cyclists averaged 57. The cyclists exercise was high enough to achieve a training response; that of the walkers was not. The cyclists therefore achieved better health benefits from their exercise. By Pedalling Healthhttp://www.kenkifer.com/bikepages/health/pedal_h.htm

Can Small Investors Follow along with Warren Buffett

Can Small Investors Follow along with Warren Buffett

Warren Buffett is the world's most successful investor. His investment strategy works marvelously well - for Warren Buffett. In our experience, many small investors lose money trying to follow in Buffett's footsteps. Buffett works with a list of companies whose stock he would like to own. He monitors these companies and their management teams. He is prepared to wait years for an opportunity to buy these stocks at the right price. If a stock never reaches his target price, Warren does not buy it - no matter how much he likes the look of it. If a stock reaches his target price, he buys big. Then he waits. This is the "classic" and best-known Buffett investment method. (He has several.) Over time, his stock buying decisions have been amply rewarded. So how does Warren Buffett identify the stocks he would like to own? Firstly he selects the stocks of companies with a uniquely competitive market position. Often the competitiveness arises through the strength of a brand name such as Coca-Cola or Gillette. He buys a stock if and only if its share price drops below its long-term true value (intrinsic value). Having bought, Buffett typically holds for a long time - provided the companies perform to his expectations. The companies grow strongly, the share price grows strongly, and the value of Warren Buffett's stock portfolio grows strongly. Buffett advocates that investors hold a "concentrated stock portfolio". In other words, you should own a very small number of stocks, say six at most, and you should know everything there is to know about these stocks. Unfortunately, small investors often fail to implement Buffett's strategy successfully. For one thing, many of us - Buffett included, learn investing through trial and error. Sure, we read as much as we can before we begin, but reading isn't enough. It's only when you've put your own savings on the line and lost money that you really learn. Making mistakes is the way most of us learn the most important lessons. But if you've got to wait 5 years before a stock you'd like to own sells at the right price, then you're going to miss out on a lot of market experience. And then it turns out you waited five years to make your first mistake. The next five years will give you a lot of time to reflect on that. You just have to hope that you learn enough from your first mistake not to make a second. Small investors who want to invest like Warren Buffet fail firstly because they do not have access to the quality of information Buffett has. Compared with most of us, Warren Buffett has enjoyed a privileged position from the very beginnings of his career. He is the son of a United States Congressman - a Congressman who also just happened to be a stockbroker. The Buffett family has been described as "pillars" of their home state of Omaha. From the start, Warren Buffett has been able to chat with and gather information and advice from CEO's and other big movers that small investors have no access to. Warren began trading in stocks at the tender age of 11 years. Beginning investors fail because they learn in "How to be a New Warren Buffett" books that they must invest with a ten-year perspective or longer. When their stocks go up, they're happy. When their stocks do down, they're less happy but they tell themselves "I'm a long term investor". When their stocks continue to go down, they get worried. When their stocks go down even further, they eventually give in and sell - at a big loss. They do not have the long-term confidence in their stocks that Buffett - through superior information sources and superior market experience - has in his. Buffett buys his stocks with a skill few of us can match. Most small investors, filled with enthusiasm from reading "How to be a New Warren Buffett " rush out and buy stocks. Unfortunately, most of them pay too much for their stocks or the stocks don't have as good long-term prospects of Buffett's own picks. They fail because, in addition to lacking Buffett's superior access to information, they lack his temperament. Buffett says if you cannot watch your portfolio lose 50 percent of its value without becoming panic-stricken, you shouldn't be in the market. Well, according to that criterion, most of us should think very hard before investing in stocks. Although perhaps not panic stricken, most of us would be deeply perturbed if our portfolio lost half its value. For most of us, the money we're putting into stocks is hard earned. To watch it disappear is distressing. Many investors doggedly hold on to their inferior stocks, believing they are following the Buffett way. In reality they aren't and they will not be rewarded because they paid too much in the first place for inferior stocks. Small investors fail because they do not have Warren Buffett's genes. Buffett is an unparalleled genius who has thought deeply about investment for decades. He has developed an immense array of strategies and tactics to keep his wealth increasing, irrespective of market conditions. You should no more think you might emulate Warren Buffett in the space of a few years than believe that by studying physics in your spare time for month or two, you might emulate Albert Einstein or Isaac Newton. Our opinion is that SEND and TREND are more useful tools for most small investors than Warren Buffett's methods. SEND identifies stocks that should do well. TREND keeps you in them while they do well and gets you out when the market begins to grow wary of them. In our opinion, Warren Buffett's methods are appropriate for highly experienced investors who share Buffett's temperament. New investors may be happier beginning their investing careers with other investment methods. By investingator.comhttp://www.investingator.com/warren-buffett-investment-strategy.html

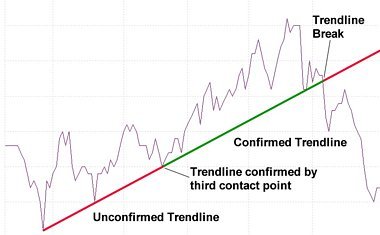

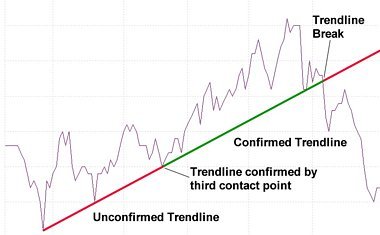

The Uptrend

An uptrend occurs when stock prices trace higher highs and higher lows. We can add a rising trendline to a chart by linking the low points. This is shown in the chart below.  Some trends continue for many months or years, others for days or weeks. We need an objective measure of the point at which a trend begins and ends.As soon as we have two consecutive lows on a price chart we can join them to make an unconfirmed trendline. For a trendline to be confirmed, and hence validated, the share price must respect it by rebounding from it a third time. A buy signal is generated when the trendline is confirmed / validated. Provided the share price stays above the trendline, we hold on to the stock. We continue to hold until a sell signal is generated by a trendline break. We then stay out of this stock until either a trendline break signals the end of the downtrend or, more conservatively, until a new uptrend is confirmed. By investingator.comhttp://www.investingator.com/uptrend.html

Some trends continue for many months or years, others for days or weeks. We need an objective measure of the point at which a trend begins and ends.As soon as we have two consecutive lows on a price chart we can join them to make an unconfirmed trendline. For a trendline to be confirmed, and hence validated, the share price must respect it by rebounding from it a third time. A buy signal is generated when the trendline is confirmed / validated. Provided the share price stays above the trendline, we hold on to the stock. We continue to hold until a sell signal is generated by a trendline break. We then stay out of this stock until either a trendline break signals the end of the downtrend or, more conservatively, until a new uptrend is confirmed. By investingator.comhttp://www.investingator.com/uptrend.html

Your Hair Is An Important Component Of Your Body

Your Hair Is An Important Component Of Your Body

We have about 100,000 hairs on our heads. Each hair shaft has three layers, with the cuticle, or outside layer, protecting the two inner layers. Shiny hair is a sign of health because the layers of the cuticle lie flat and reflect light. When the scales of the cuticle lie flat they overlap tightly, so the inner layers are well protected from heat, sun, chlorine, and all the other hazards that can come from living in our environment. When hair is damaged, though, the scales may separate and hair can become dry. Because the scales on dry hair don't protect the inner two layers as well, hair can break and look dull. The type of hair a person has - whether it's straight or curly - can also affect how shiny it is. Sebum, which is the natural oil on the hair, covers straight hair better than curly hair, which is why straight hair can appear shinier.Depending how long a person's hair is or how fast it grows, the end of each hair shaft can be a couple of years old. So the hair at the end of the shaft could have survived a few summers of scorching sun and saltwater and winters of cold, dry air. How well you care for your hair from the time it emerges from the root plays a role in how healthy it looks.

Caring for HairHow you take care of your hair depends on the type of hair you have, your lifestyle, and how you style your hair.

Your hair typePeople with dry, curly hair have different hair care needs than people with straight, fine hair. But all hair needs to be treated gently, especially when it's wet. Wet hair can stretch, making it more vulnerable to breakage or cuticle damage. That's why using a hot blow-dryer (or other heat styling products) on very wet hair can damage it. Some people find that their hair gets oily in their teen years. That's because the hair follicles contain sebaceous glands that make sebum, which moisturizes the hair and skin. During adolescence, the sebaceous glands may become overactive, producing more oil than needed. As with acne, oily hair is usually a temporary part of puberty. Many teens care for oily hair by washing it once a day - or more if they're active. As long as you treat your hair gently when it's wet, frequent washing shouldn't harm it. If you have acne, it's a good idea to keep the hair around your face clean so hair oils don't clog your pores.If you're washing your hair every day or more, it may be better to choose a mild shampoo instead of a shampoo designed for oily hair. For some people - especially people with fine, fragile, or combination hair (hair that's oily at the crown but dry on the ends) - shampoos for oily hair can be too harsh. If you have oily hair and want to use a conditioner, choose one that's made for oily hair.If your hair is dry, it's a good idea to wash it less frequently. Some people only need to wash their hair once a week - and that's fine. Many people who have curly hair also have dry hair. Curly and dry hair types are usually more fragile than straight hair, so you'll need to be especially careful about using heat styling products. Shampoos made for dry hair and hair conditioners can help.

Your activity level and interests. Do you play sports or spend a lot of time at the beach? These kinds of things can affect your hair. For example, if you're an athlete with oily hair, you may want to wash your hair after working up a sweat during practice and games. But if you're a lifeguard or a swimmer, sun and saltwater (or the chlorine in pool water) can dry your hair out, no matter what your hair type. If you're exposed to sun, wind, or other elements, you may want to use a shampoo designed for dry hair or use a conditioner. It's also a good idea to wear a hat to protect your hair when you're outdoors.

Your hairstyleHeat styling products like curling and straightening irons can dry out even oily hair if they're used too much. Follow the instructions carefully, and don't use them on wet hair or high settings, and give your hair a vacation from styling once in a while. Ask your hair stylist or dermatologist for advice on using heat styling products. Chemical treatments can also harm hair if they're not used properly. If you decide you want a chemical treatment to color, straighten, or curl your hair, it's best to trust the job to professionals. Stylists who are trained in applying chemicals to hair will be able to evaluate your hair type and decide which chemicals will work best for you. Here are some things to be aware of when getting chemical treatments:Relaxers Relaxers (straighteners) work by breaking chemical bonds in curly hair. Relaxers containing lye can cause skin irritation and hair breakage. Although "no lye" relaxers may cause less irritation, both types of relaxers can cause problems if they are used in the wrong way (for example, if they're mixed incorrectly or left on the hair for too long). Scratching, brushing, or combing your hair right before a chemical relaxing treatment can increase these risks. And don't use relaxers - or any hair treatment - if your scalp is irritated. If you decide to keep straightening your hair, you'll need to wait at least 6 weeks before your next treatment to protect your hair. Relaxers can cause hair breakage when used over a period of time, even when they're used properly. Using blow-dryers, curling or straightening irons, or color on chemically relaxed hair can also increase the risk of damage.

PermsPerms take straight hair and make it curly. The risks are similar to those associated with relaxers. ColorThere are two types of color: permanent (which means the color stays in your hair until it grows out) and semi-permanent (the color washes out after a while). Some semi-permanent coloring treatments, like henna, are fairly safe and easy to use at home. Some people get a condition called contact dermatitis (an allergic reaction with a rash) from henna and other "natural" products, so be sure to test a small area first. Other color treatments - especially permanent treatments - can cause hair loss, burning, redness, and irritation. A few types of coloring treatments can cause allergic reactions in certain people, and in rare cases these can be very serious. So talk to your stylist if you are worried that you may be sensitive to the products. Also, talk to your stylist about doing a patch test before using a product. And never use hair dyes on your eyelashes or eyebrows.Regular haircuts are one of the best ways to help keep hair healthy. Even if you have long hair or you're trying to grow your hair, a haircut can help protect the ends of your hair from splitting and damage. In fact, cutting may actually help your hair grow better because it's healthy and not breaking off.Dealing With Hair ProblemsHere are some common hair problems - and tips on how to deal with them.DandruffDandruff - or flakes of dead skin - can be noticeable in a person's hair and on clothing. No one really knows what causes dandruff, although recent studies seem to show that it may be caused by a type of fungus. Dandruff isn't contagious or dangerous. Over-the-counter shampoos containing salicylic acid, zinc, tars, or selenium sulfide can reduce dandruff flakes. When shampooing, scrub your hair for at least 5 minutes, loosening the flakes with your fingers. Rinse your hair well after washing. If your dandruff doesn't improve, see your doctor. He or she may prescribe a prescription shampoo and possibly a lotion or liquid to rub into your scalp.

Hair BreakageHair can break when points in the hair thicken or weaken. Sometimes this happens near the scalp so a person's hair never grows very long. When hairs break at the ends, they're called "split ends," and the splits can travel up the hair shaft.A major cause of hair breakage is improper use of chemical hair treatments, like the treatments described above. But brushing or combing hair too frequently or in the wrong way (such as using a fine-toothed comb on very thick, curly hair or teasing hair) can lead to breakage. Hair extensions and braids can also cause breakage. Leaving them in too long or pulling them out without professional help can cause hair and scalp damage or even hair loss.Sometimes hair breakage and dry, brittle hair are signs of a medical problem, such as hypothyroidism or an eating disorder. If your hair is breaking even though you don't treat it with chemicals or other styling products, see a doctor.

Hair Loss (Alopecia)It's normal for everyone to lose some hair. In fact, we lose about 100 hairs each day as old hairs fall out and are replaced with new ones. With hair loss, though, hair thins at a rate that can't be replaced. When hair falls out and isn't replaced by new hair, a person can become bald or have bald patches. Hair loss can be temporary or permanent, depending on the cause. If changing your hairstyle or other treatment doesn't help, see a doctor. He or she may prescribe a drug to slow or stop hair loss and to help hair grow. As with the rest of our bodies, hair is healthiest when we eat right, exercise, and protect it from too much sun. By Eliot N. Mostow, MD, MPH, and Margaret Kessler, MSIVhttp://www.kidshealth.org/

Using Brown Rice Instead Of White Rice For Sushi RollsBrown rice is not traditionally used for sushi in Japan, but since it's such a healthy whole grain, we've decided to bend the rules. For more information about rolling sushi, see "Ready to Roll." You'll have leftover vegetables, which are great for salads.

Using Brown Rice Instead Of White Rice For Sushi RollsBrown rice is not traditionally used for sushi in Japan, but since it's such a healthy whole grain, we've decided to bend the rules. For more information about rolling sushi, see "Ready to Roll." You'll have leftover vegetables, which are great for salads.

IngredientsScant 2/3 cup short-grain brown rice*1 cup plus 1 teaspoon water2 teaspoons soy sauce 2 tablespoons seasoned rice vinegar**1 teaspoon wasabi powder**2 (8 1/4- by 7 1/4-inch) sheets roasted nori** (dried laver) 1/2 Kirby cucumber, peeled, seeded, and cut into 1/16-inch-thick matchsticks1/2 carrot, cut into 1/16-inch-thick matchsticks1/2 firm-ripe small California avocado 3/4 oz radish sprouts*, roots trimmed

Special equipment: a bamboo sushi mat** Accompaniments: soy sauce for dipping; sliced gari** (pickled ginger) PreparationRinse rice well and bring to a boil with 1 cup water and 1 teaspoon soy sauce in a 1- to 1 1/2-quart heavy saucepan, then reduce heat to very low and simmer, tightly covered, until water is absorbed, about 40 minutes. Remove from heat and let rice stand, covered, 10 minutes.

While rice is standing, stir together vinegar and remaining teaspoon soy sauce. Transfer rice to a wide nonmetal bowl (preferably wood, ceramic, or glass) and sprinkle with vinegar mixture, tossing gently with a large spoon to combine. Cool rice, tossing occasionally, about 15 minutes. Stir together wasabi and remaining teaspoon water to form a stiff paste. Let stand at least 15 minutes (to allow flavors to develop). Place sushi mat on a work surface with slats running crosswise. Arrange 1 sheet nori, shiny side down, on mat, lining up a long edge of sheet with edge of mat nearest you. Using damp fingers, gently press half of rice (about 3/4 cup) onto nori in 1 layer, leaving a 1 3/4-inch border on side farthest from you. Arrange half of cucumber in an even strip horizontally across rice, starting 1 inch from side nearest you. (You may need to cut pieces to fit from side to side.) Arrange half of carrot just above cucumber in same manner. Peel avocado half and cut lengthwise into thin slices, then arrange half of slices just above carrot in same manner. Repeat with radish sprouts, letting some sprout tops extend beyond edge.

Beginning with edge nearest you, lift mat up with your thumbs, holding filling in place with your fingers, and fold mat over filling so that upper and lower edges of rice meet, then squeeze gently but firmly along length of roll, tugging edge of mat farthest from you to tighten. (Nori border will still be flat on mat.) Open mat and roll log forward to seal with nori border. (Moisture from rice will seal roll.) Transfer roll, seam side down, to a cutting board. Make second log in same manner, then cut each log crosswise into 6 pieces with a wet thin-bladed knife. Serve with wasabi paste, soy sauce, and ginger. Cooks' notes:• If you prefer to use white sushi rice, cook the same amount of rice with 1 cup water 15 minutes. Omit all soy sauce from rice and replace with 1/4 teaspoon salt dissolved in 2 tablespoons rice vinegar. • If you aren't able to find seasoned rice vinegar, dissolve 2 teaspoons sugar in 2 tablespoons unseasoned rice vinegar. *Available at natural foods stores and some supermarkets.**Available at Asian markets and sushifoods.com.By epicurious.comhttp://www.epicurious.com/

The secret to long-term wealth is stocks, stocks and stocks. Diversifying into bonds, hedge funds and works of art is also a sensible ploy1. Buy bargain blue chips If you look at Morgan Stanley International's Far East index, you'll find that it has returned 2,100% in capital gains since its inception in December 1969 — an average of nearly 70% a year. Even Japan, whose economy has been stagnant for a decade, has seen its Morgan Stanley stock index rise 2,166% in the same period. Hong Kong? Up 2,872% over three decades despite its descent into recession this year.In the U.S., the Dow Jones Industrial Average has soared from around 40 points, when the index was established in 1896, to about 9,700 points last week. Many crises have hit the New York Stock Exchange — the Great Depression of 1929, the bombing of Pearl Harbor in 1941, the Black October crash in 1987, and now, the terrorist attacks on New York and the Pentagon on Sept. 11. Each time the Dow dropped like a stone — only to bounce back to greater heights.The lesson: Anchor your portfolio in top stocks — known as "blue chips" in many markets — and hang on to them. Accumulate more shares when there's blood in the streets. "Good quality companies are always the first to turn around when the market rebounds," says Peter Reichenbach, managing director of Swiss-based Gottardo Asset Management. "I'd suggest global blue chips. With internationally strong companies, you don't have to worry that they won't be around next year." U.S. multinationals General Electric and Citigroup are trading at reasonable price-earning ratios — 24 times and 15 times forecast 2002 profits, respectively — compared with their historical valuations. In Asia, consider Hong Kong banking giant HSBC, which consistently tops surveys on companies with good corporate governance. Robert Rountree, chief Asia strategist for Prudential Bache Securities, singles out "big battered names" Samsung Electronics in Korea and chip foundries TSMC and UMC in Taiwan. "They're so grossly oversold," he says.In addition to direct holdings in blue chips, consider exchange-traded funds. These are listed vehicles that invest in index constituents. The downside: you get exposure to clunkers, such as badly run conglomerates included in an index only because they are too big to ignore. The Tracker Fund of Hong Kong mimics the Hang Seng index, while DIAMONDS and SPIDERS in Singapore replicate the Dow and S&P 500, respectively.2. Get steady income from cash payers There's no better proof of a company's strong fundamentals than the evidence of the dividends it pays out year after year. Small-cap companies often grant the highest and most consistent payouts. At HK$3.20 per share, Hung Hing Printing boasts a dividend yield of nearly 9%, while Kingmaker Footwear, at HK$1.40, yields 6.7%. Cycle & Carriage in Malaysia and Cerebos Pacific in Singapore are each forecast to have a dividend yield of better than 7% next year. National Petrochemical, which has yet to be included in the Bangkok index, has an impressive 15% yield. Because they have been sold down, some blue chips now have substantial dividend yields, too. Hang Seng Bank in Hong Kong, Indonesian cigarette maker Gudang Garam and Philippine liquor manufacturer La TondeNa each have a cash return of 6%. 3. Lower your risk with bread-and-butter companiesIn good times and bad, people have to eat, use water and electricity, take medicine and travel to work and school. Companies that provide these basic services may be boring, but they are dependable investments. That's assuming they do not stray from their core business. A power utility that has sunk money in Internet ventures, for example, has taken on risk that the investor has to take into account. Power generators and distributors are the havens of choice in uncertain times. Investors have been bidding up their stock price even before Sept. 11 on fears of a global economic recession. "They've outperformed in the last 18 months," notes Markus Rosgen of ING Barings in Hong Kong. "By the second half of next year, when the global economy is expected to recover, they won't be able to increase very much." He favors oil companies instead. At HK$1.40, PetroChina, Asia's most profitable company, boasts a dividend yield of 10%.Rosgen also likes oil-dependent firms like Hong Kong airline Cathay Pacific. "These companies are cyclical, so as soon as demand comes back up, they'll rebound quickly." People may have fear of flying now, but air travel is still essential. "We like airlines because they've been so badly battered," says Ajay Kapur, Asia strategist for Morgan Stanley in Hong Kong. "Over a 12-month horizon, the good airlines in Asia will all be substantially higher from these low levels." At S$8.90, consistent moneymaker Singapore Airlines, which recently cut executive pay by 15%, is trading at only seven times last year's earnings.Companies in food, medicine and household products are also good bets. "Pharmaceuticals are always a stable choice," says Norman Chan, head of research at financial adviser Allen Perkins in Hong Kong. "I like Pfizer, which is one of the most value-driven large-cap drug stocks." The New York-listed stock is not cheap — it's trading at 25 times forecast 2002 earnings — but Pfizer is expected to grow by 20% annually in the next five years. Mark Monson, head of fund management for Gottardo Asset Management, favors Japan's Takeda Chemicals, which makes medicines, and Kao, the country's biggest maker of detergents. "It's the Japanese Procter & Gamble," he says. Monson praises the two companies for their excellent management, strong brands and dominant market share. 4. Security-oriented firms can be good short-term betsBut don't hold them too long. "Security and defense-oriented companies are definitely a good buy," says Gottardo managing director Reichenbach. "They will benefit from increased spending. But they're probably one-off investments." Warns Rosgen: "People always overexaggerate the potential of safety and security companies when something terrible happens. A few months later, everything is forgotten." Adds Chan: "If the global economy does turn around next year, these stocks could suffer."Still, the stock of U.S. companies like fighter-plane maker Lockheed Martin and missile specialist Raytheon have soared after Sept. 11. The U.S. Congress recently approved $20 billion in additional defense spending. David Hale, chief global economist and strategist at Zurich Financial Group in Chicago, estimates extra security-related expenditures by the government and businesses in the U.S. at $20 billion to $30 billion a year. In Asia, Reichenbach points to Japan's Mitsubishi and ST Engineering in Singapore as "good buys at this time." Mitsubishi Heavy Industries is reported to be in talks to manufacture vertical-missile launches as part of U.S. Aegis air defense systems on naval destroyers. Japan plans to buy the ships, but wants them equipped with Japanese parts. ST Engineering is working with Boeing to improve the safety of its commercial planes. 5. Ride enterprises at the forefront of China's still booming economy Almost everyone is bullish on the mainland, which was finally admitted into the World Trade Organization (WTO) last week. "China is the only growing major area in the world," says Chan. "It shouldn't be affected too much by a global recession, as long as the U.S. doesn't completely collapse." Hale is very upbeat. "The China growth story is driven by the most extraordinary revolution of the last 200 years — the successful transformation of a communist country into a market economy," he says. "China has laid off 45 million people from state enterprises in the past five years. It will soon overtake Britain as the world's second-largest destination of foreign direct investment. Sure, there is the problem of overbuilding and overcapacity in some segments, but overall I'm very bullish on China."The key is to focus on consumer-oriented companies because exporters are even now getting hit by the global recession. That means retailers, car makers, telecom providers — and even power utilities, because electricity usage in factories and homes will continue surging in an economy that is expanding at 7% or higher every year. But choose carefully. While WTO membership will bring a wave of foreign capital, it will also open the doors to foreign competition. Look out for bad governance as well. China's regulators are moving to improve corporate transparency and adherence to regulations, but it could take a decade to bring up standards to, say, Hong Kong's or Singapore's. A series of scandals and the regulators' tough response to them have contributed to the decline in locals-only A-shares and in B-shares, which are open to both local and foreign investors. Even then, shares are still overvalued as too much money chases too few stocks. "It's possible for A-shares to fall 40% to 50% in the next few months," warns Hale.Your best bet is to accumulate shares in mainland companies listed in Hong Kong, Singapore and the U.S. You get exposure to China's hot economy, but get a measure of protection from the more stringent oversight of foreign stock markets. Analyst favorite PetroChina, for example, is listed in Hong Kong and New York. Dominant cellular phone operator China Mobile trades in Hong Kong. The so-called H-shares and red chips — mainland companies and other firms doing business in China that are listed in Hong Kong — trade at far lower valuations than their peers in China, which have price-earnings ratios of 60 times or higher. "They're very good value," says Reichenbach. "I'd pick companies like Shandong Power and the toll-road companies, such as Zhejiang Expressway, and even China Mobile." There's ambivalence about the mobile-phone operator because of fears the Chinese government will change pricing policies (both the caller and the person receiving the call currently pay) and will open the telecom market to new players. But China's 1.3-billion population is big enough to support China Mobile, its sole rival China Unicom, and other potential competitors. China Mobile is also looking cheap. "The premium investors pay for its growth prospects is quite minimal relative to where it's been and relative to other [companies] with similar returns on capital investment," says Dio Wong, regional strategist for Merrill Lynch in Hong Kong. China Mobile was trading at HK$26 per share on Nov. 14, down 50% from its 52-week high.6. Diversify into selected bonds When the American bond market reopened after the Sept. 11 tragedy, the prices of U.S. Treasury bonds spiked so high that yields plunged by 50 basis points, a massive decline for ultra safe fixed income instruments. "Bonds tend to be overpriced right now," says Reichenbach. "There are few great deals in bonds and cash."Still, no portfolio should be 100% in stocks, and bonds with reasonable yields are better alternatives to bank deposits — and are nearly as safe. Consider the long-term corporate debt of blue chips like Hong Kong's Hutchison Whampoa. Many long-dated corporate bonds have fallen in price as international investors sold them in favor of U.S. Treasuries. At one point last month, Hutchison's bonds maturing in 2011 traded at 230 points over U.S. Treasuries. Other analyst favorites include bonds issued by oil company Petronas and power utility Tenaga Nasional, both in Malaysia, and Korean oil refiner S.K. Corp.Fixed income instruments tend to be denominated in the high six figures, so ordinary investors typically buy bond mutual funds to gain exposure to them. Baring GUF High Yield Bond, whose financial strength and quality of management are rated a high "AA" by Standard & Poor's, focuses on global corporate debt, including those of Asian firms. Other well-regarded bond funds include Janus World High Yield and Investec GSF USD High Income. 7. Hedge funds provide safety nets in bad times Previously available only to millionaires, hedge funds are now within the reach of ordinary investors for as low as $30,000. That's the minimum subscription for AHL Diversified Futures in Hong Kong, which uses sophisticated computer programs to hunt for differences in the prices of futures instruments in different markets. It's up 23% so far this year. "Hedge funds are not hugely exciting, but that's what's good about them," says David Chapman, senior manager of regional financial adviser Towry Law's asset management division. In good times and bad, he says, "they generate steady returns of 10% to 12% a year, and in some cases, 15%." Hedge funds typically take long positions on some securities, shorting others. They won't win big, but they won't lose hugely either.There are more than 4,000 hedge funds managed by some 1,500 financial houses using various strategies. Managed futures are the flavor of the moment. "In the last two months, they have outperformed all other hedge-fund strategies," says Linda Wong, group deputy director at Allen Perkins. "Many managed futures hedge funds delivered a 20% return." But there's no telling whether the trend will continue. For the conservative investor, a good option is a fund-of-funds such as the Momentum All Weather Fund (minimum: $25,000), which invests in nearly 30 hedge funds that follow different strategies and operate in various markets.8. Bargain art pieces bring pleasure and capital gains At an art auction in Hong Kong earlier this month, one mainland Chinese woman elicited titters with her unorthodox bidding. She never put down her paddle as others in the room tried to top offers for Nine Buffalos, an ink drawing by Chinese artist Li Keran. The woman won the bidding for the artwork — for $485,000. The rise of the cash-rich mainland art collector may be one of the side effects of China's economic boom. "Now is a good time to buy before the mainland Chinese market opens up," says Rose Wong, director for jadeite jewelry at auction house Christie's. She expects jade prices to soar in the next three to five years as Chinese grow wealthier. Because of the prospect of a global recession, many art pieces are priced at bargain levels compared with what owners were asking for 10 years ago. A Ming Dynasty vase that sold for $225,000 in 1998, for example, had a floor price of just $90,000 to $115,000 at a recent auction. You may want to acquire Chinese pieces now in anticipation of higher prices when mainland collectors hit their stride. Or you may opt for Western works and other antiques to ride renewed interest in art when the global economy gets back on track. Whatever your choice, make sure you buy top-notch works of art that you really like. That Ming vase can sit in your study for five years or more before you see its value appreciate substantially.9. Time to buy a dream home — to live in You'd have to look long and hard to find a bullish property analyst these days, especially in Hong Kong. "People here have not yet woken up to the fact that property is no longer an asset class," says Rountree of Prudential Bache. "Property in Hong Kong has seen its better times and we're not going to see the same upside over the next few years." But what's bad for investors can be good news to first-time homeowners. If you're still renting, now may be the time to buy your dream castle.Mortgages are at all-time lows — and likely to fall further as the U.S. Federal Reserve moves to stimulate the economy. "Your mortgage installments will probably be much lower than your monthly rental right now," says billionaire Robert Ng, chairman of Sino Land, Hong Kong's fourth-largest property group. "I don't see the point of people who say they'd rather keep their money in cash and rent an apartment."By ASSIF SHAMEEN and MARIA CHENGhttp://www.asiaweek.com/

The secret to long-term wealth is stocks, stocks and stocks. Diversifying into bonds, hedge funds and works of art is also a sensible ploy1. Buy bargain blue chips If you look at Morgan Stanley International's Far East index, you'll find that it has returned 2,100% in capital gains since its inception in December 1969 — an average of nearly 70% a year. Even Japan, whose economy has been stagnant for a decade, has seen its Morgan Stanley stock index rise 2,166% in the same period. Hong Kong? Up 2,872% over three decades despite its descent into recession this year.In the U.S., the Dow Jones Industrial Average has soared from around 40 points, when the index was established in 1896, to about 9,700 points last week. Many crises have hit the New York Stock Exchange — the Great Depression of 1929, the bombing of Pearl Harbor in 1941, the Black October crash in 1987, and now, the terrorist attacks on New York and the Pentagon on Sept. 11. Each time the Dow dropped like a stone — only to bounce back to greater heights.The lesson: Anchor your portfolio in top stocks — known as "blue chips" in many markets — and hang on to them. Accumulate more shares when there's blood in the streets. "Good quality companies are always the first to turn around when the market rebounds," says Peter Reichenbach, managing director of Swiss-based Gottardo Asset Management. "I'd suggest global blue chips. With internationally strong companies, you don't have to worry that they won't be around next year." U.S. multinationals General Electric and Citigroup are trading at reasonable price-earning ratios — 24 times and 15 times forecast 2002 profits, respectively — compared with their historical valuations. In Asia, consider Hong Kong banking giant HSBC, which consistently tops surveys on companies with good corporate governance. Robert Rountree, chief Asia strategist for Prudential Bache Securities, singles out "big battered names" Samsung Electronics in Korea and chip foundries TSMC and UMC in Taiwan. "They're so grossly oversold," he says.In addition to direct holdings in blue chips, consider exchange-traded funds. These are listed vehicles that invest in index constituents. The downside: you get exposure to clunkers, such as badly run conglomerates included in an index only because they are too big to ignore. The Tracker Fund of Hong Kong mimics the Hang Seng index, while DIAMONDS and SPIDERS in Singapore replicate the Dow and S&P 500, respectively.2. Get steady income from cash payers There's no better proof of a company's strong fundamentals than the evidence of the dividends it pays out year after year. Small-cap companies often grant the highest and most consistent payouts. At HK$3.20 per share, Hung Hing Printing boasts a dividend yield of nearly 9%, while Kingmaker Footwear, at HK$1.40, yields 6.7%. Cycle & Carriage in Malaysia and Cerebos Pacific in Singapore are each forecast to have a dividend yield of better than 7% next year. National Petrochemical, which has yet to be included in the Bangkok index, has an impressive 15% yield. Because they have been sold down, some blue chips now have substantial dividend yields, too. Hang Seng Bank in Hong Kong, Indonesian cigarette maker Gudang Garam and Philippine liquor manufacturer La TondeNa each have a cash return of 6%. 3. Lower your risk with bread-and-butter companiesIn good times and bad, people have to eat, use water and electricity, take medicine and travel to work and school. Companies that provide these basic services may be boring, but they are dependable investments. That's assuming they do not stray from their core business. A power utility that has sunk money in Internet ventures, for example, has taken on risk that the investor has to take into account. Power generators and distributors are the havens of choice in uncertain times. Investors have been bidding up their stock price even before Sept. 11 on fears of a global economic recession. "They've outperformed in the last 18 months," notes Markus Rosgen of ING Barings in Hong Kong. "By the second half of next year, when the global economy is expected to recover, they won't be able to increase very much." He favors oil companies instead. At HK$1.40, PetroChina, Asia's most profitable company, boasts a dividend yield of 10%.Rosgen also likes oil-dependent firms like Hong Kong airline Cathay Pacific. "These companies are cyclical, so as soon as demand comes back up, they'll rebound quickly." People may have fear of flying now, but air travel is still essential. "We like airlines because they've been so badly battered," says Ajay Kapur, Asia strategist for Morgan Stanley in Hong Kong. "Over a 12-month horizon, the good airlines in Asia will all be substantially higher from these low levels." At S$8.90, consistent moneymaker Singapore Airlines, which recently cut executive pay by 15%, is trading at only seven times last year's earnings.Companies in food, medicine and household products are also good bets. "Pharmaceuticals are always a stable choice," says Norman Chan, head of research at financial adviser Allen Perkins in Hong Kong. "I like Pfizer, which is one of the most value-driven large-cap drug stocks." The New York-listed stock is not cheap — it's trading at 25 times forecast 2002 earnings — but Pfizer is expected to grow by 20% annually in the next five years. Mark Monson, head of fund management for Gottardo Asset Management, favors Japan's Takeda Chemicals, which makes medicines, and Kao, the country's biggest maker of detergents. "It's the Japanese Procter & Gamble," he says. Monson praises the two companies for their excellent management, strong brands and dominant market share. 4. Security-oriented firms can be good short-term betsBut don't hold them too long. "Security and defense-oriented companies are definitely a good buy," says Gottardo managing director Reichenbach. "They will benefit from increased spending. But they're probably one-off investments." Warns Rosgen: "People always overexaggerate the potential of safety and security companies when something terrible happens. A few months later, everything is forgotten." Adds Chan: "If the global economy does turn around next year, these stocks could suffer."Still, the stock of U.S. companies like fighter-plane maker Lockheed Martin and missile specialist Raytheon have soared after Sept. 11. The U.S. Congress recently approved $20 billion in additional defense spending. David Hale, chief global economist and strategist at Zurich Financial Group in Chicago, estimates extra security-related expenditures by the government and businesses in the U.S. at $20 billion to $30 billion a year. In Asia, Reichenbach points to Japan's Mitsubishi and ST Engineering in Singapore as "good buys at this time." Mitsubishi Heavy Industries is reported to be in talks to manufacture vertical-missile launches as part of U.S. Aegis air defense systems on naval destroyers. Japan plans to buy the ships, but wants them equipped with Japanese parts. ST Engineering is working with Boeing to improve the safety of its commercial planes. 5. Ride enterprises at the forefront of China's still booming economy Almost everyone is bullish on the mainland, which was finally admitted into the World Trade Organization (WTO) last week. "China is the only growing major area in the world," says Chan. "It shouldn't be affected too much by a global recession, as long as the U.S. doesn't completely collapse." Hale is very upbeat. "The China growth story is driven by the most extraordinary revolution of the last 200 years — the successful transformation of a communist country into a market economy," he says. "China has laid off 45 million people from state enterprises in the past five years. It will soon overtake Britain as the world's second-largest destination of foreign direct investment. Sure, there is the problem of overbuilding and overcapacity in some segments, but overall I'm very bullish on China."The key is to focus on consumer-oriented companies because exporters are even now getting hit by the global recession. That means retailers, car makers, telecom providers — and even power utilities, because electricity usage in factories and homes will continue surging in an economy that is expanding at 7% or higher every year. But choose carefully. While WTO membership will bring a wave of foreign capital, it will also open the doors to foreign competition. Look out for bad governance as well. China's regulators are moving to improve corporate transparency and adherence to regulations, but it could take a decade to bring up standards to, say, Hong Kong's or Singapore's. A series of scandals and the regulators' tough response to them have contributed to the decline in locals-only A-shares and in B-shares, which are open to both local and foreign investors. Even then, shares are still overvalued as too much money chases too few stocks. "It's possible for A-shares to fall 40% to 50% in the next few months," warns Hale.Your best bet is to accumulate shares in mainland companies listed in Hong Kong, Singapore and the U.S. You get exposure to China's hot economy, but get a measure of protection from the more stringent oversight of foreign stock markets. Analyst favorite PetroChina, for example, is listed in Hong Kong and New York. Dominant cellular phone operator China Mobile trades in Hong Kong. The so-called H-shares and red chips — mainland companies and other firms doing business in China that are listed in Hong Kong — trade at far lower valuations than their peers in China, which have price-earnings ratios of 60 times or higher. "They're very good value," says Reichenbach. "I'd pick companies like Shandong Power and the toll-road companies, such as Zhejiang Expressway, and even China Mobile." There's ambivalence about the mobile-phone operator because of fears the Chinese government will change pricing policies (both the caller and the person receiving the call currently pay) and will open the telecom market to new players. But China's 1.3-billion population is big enough to support China Mobile, its sole rival China Unicom, and other potential competitors. China Mobile is also looking cheap. "The premium investors pay for its growth prospects is quite minimal relative to where it's been and relative to other [companies] with similar returns on capital investment," says Dio Wong, regional strategist for Merrill Lynch in Hong Kong. China Mobile was trading at HK$26 per share on Nov. 14, down 50% from its 52-week high.6. Diversify into selected bonds When the American bond market reopened after the Sept. 11 tragedy, the prices of U.S. Treasury bonds spiked so high that yields plunged by 50 basis points, a massive decline for ultra safe fixed income instruments. "Bonds tend to be overpriced right now," says Reichenbach. "There are few great deals in bonds and cash."Still, no portfolio should be 100% in stocks, and bonds with reasonable yields are better alternatives to bank deposits — and are nearly as safe. Consider the long-term corporate debt of blue chips like Hong Kong's Hutchison Whampoa. Many long-dated corporate bonds have fallen in price as international investors sold them in favor of U.S. Treasuries. At one point last month, Hutchison's bonds maturing in 2011 traded at 230 points over U.S. Treasuries. Other analyst favorites include bonds issued by oil company Petronas and power utility Tenaga Nasional, both in Malaysia, and Korean oil refiner S.K. Corp.Fixed income instruments tend to be denominated in the high six figures, so ordinary investors typically buy bond mutual funds to gain exposure to them. Baring GUF High Yield Bond, whose financial strength and quality of management are rated a high "AA" by Standard & Poor's, focuses on global corporate debt, including those of Asian firms. Other well-regarded bond funds include Janus World High Yield and Investec GSF USD High Income. 7. Hedge funds provide safety nets in bad times Previously available only to millionaires, hedge funds are now within the reach of ordinary investors for as low as $30,000. That's the minimum subscription for AHL Diversified Futures in Hong Kong, which uses sophisticated computer programs to hunt for differences in the prices of futures instruments in different markets. It's up 23% so far this year. "Hedge funds are not hugely exciting, but that's what's good about them," says David Chapman, senior manager of regional financial adviser Towry Law's asset management division. In good times and bad, he says, "they generate steady returns of 10% to 12% a year, and in some cases, 15%." Hedge funds typically take long positions on some securities, shorting others. They won't win big, but they won't lose hugely either.There are more than 4,000 hedge funds managed by some 1,500 financial houses using various strategies. Managed futures are the flavor of the moment. "In the last two months, they have outperformed all other hedge-fund strategies," says Linda Wong, group deputy director at Allen Perkins. "Many managed futures hedge funds delivered a 20% return." But there's no telling whether the trend will continue. For the conservative investor, a good option is a fund-of-funds such as the Momentum All Weather Fund (minimum: $25,000), which invests in nearly 30 hedge funds that follow different strategies and operate in various markets.8. Bargain art pieces bring pleasure and capital gains At an art auction in Hong Kong earlier this month, one mainland Chinese woman elicited titters with her unorthodox bidding. She never put down her paddle as others in the room tried to top offers for Nine Buffalos, an ink drawing by Chinese artist Li Keran. The woman won the bidding for the artwork — for $485,000. The rise of the cash-rich mainland art collector may be one of the side effects of China's economic boom. "Now is a good time to buy before the mainland Chinese market opens up," says Rose Wong, director for jadeite jewelry at auction house Christie's. She expects jade prices to soar in the next three to five years as Chinese grow wealthier. Because of the prospect of a global recession, many art pieces are priced at bargain levels compared with what owners were asking for 10 years ago. A Ming Dynasty vase that sold for $225,000 in 1998, for example, had a floor price of just $90,000 to $115,000 at a recent auction. You may want to acquire Chinese pieces now in anticipation of higher prices when mainland collectors hit their stride. Or you may opt for Western works and other antiques to ride renewed interest in art when the global economy gets back on track. Whatever your choice, make sure you buy top-notch works of art that you really like. That Ming vase can sit in your study for five years or more before you see its value appreciate substantially.9. Time to buy a dream home — to live in You'd have to look long and hard to find a bullish property analyst these days, especially in Hong Kong. "People here have not yet woken up to the fact that property is no longer an asset class," says Rountree of Prudential Bache. "Property in Hong Kong has seen its better times and we're not going to see the same upside over the next few years." But what's bad for investors can be good news to first-time homeowners. If you're still renting, now may be the time to buy your dream castle.Mortgages are at all-time lows — and likely to fall further as the U.S. Federal Reserve moves to stimulate the economy. "Your mortgage installments will probably be much lower than your monthly rental right now," says billionaire Robert Ng, chairman of Sino Land, Hong Kong's fourth-largest property group. "I don't see the point of people who say they'd rather keep their money in cash and rent an apartment."By ASSIF SHAMEEN and MARIA CHENGhttp://www.asiaweek.com/

Even before the Sept. 11 terrorist attacks on the U.S., many Asian nest eggs had grown appreciably smaller. Here's what you need to know about managing what's left of your wealth in a changed worldIn a swing around Asia last week, David Hale felt he had been transported back in time. "Stocks here are really so cheap now," marvels the chief global economist and strategist for Zurich Financial Group in Chicago. "I feel I'm back in my youth as I look at companies selling at price-earning ratios of five or six times, and with dividend yields of 8%. Those are valuations I used to see 20 years ago. For stock pickers and long-term investors, Asia looks like heaven right now."But it's still hell for many local punters. When ASIAWEEK asked some of the region's high-profile investors what they'd do with $100,000, few said they would buy stocks. Financial adviser Marc Faber opted for Afghan rugs (see story page 34). Dotcom millionaire Antony Yip would invest in Shanghai property. Hong Kong socialite Shirley Hiranand would buy a flat in London. Ordinary investors are also tuning out. "I've learned my lesson," says Hong Kong engineer Leon Wong, 30, who is reeling from the 54% fall in Chinese computer maker Legend since he bought the stock in May. He believes terrorism will keep the markets depressed for years. "From now on, it's the bank for my money," he says.That's a mistake. Equities are still the way to go in building long-term wealth. Cash, bonds, property and art do have a place in a diversified portfolio. But the piles of any financial house should still be driven into a bedrock of equities. Historically, stocks return significantly higher yields over long periods compared with any other asset. There are times of excess — remember the Internet bubble? — and steep sell-offs. But if you hang on to a well-chosen basket of shares long enough, you're guaranteed more money in capital gains and dividends. "The markets," says Dio Wong, regional analyst at Merrill Lynch in Hong Kong, "always revert to the mean."Last week, the Dow Jones Industrial Average returned to its pre-Sept. 11 level of 9,600 points, having clawed back the more than $1 trillion in investor wealth that was wiped from the boards in the week after terrorist attacks on New York and Washington. The market gave back some of those gains after an American Airlines Airbus A300 crashed in New York on Nov. 12, but quickly recovered when the government said it believed the tragedy was due to mechanical failure, not terrorism. By market close on Nov. 13, the Dow had risen to 9,750. Even the latest negative numbers on the U.S. economy have not dented the new optimism. At 5.4%, the U.S. unemployment rate is the highest in 10 years. Consumer spending is also grinding to a halt. "The markets are less sensitive to bad news these days," says Norman Chan, head of research at Hong Kong financial adviser Allen Perkins.That said, the Dow and Nasdaq, along with Asian markets, are still way below their peaks last year, when the U.S. economy seemed like it could expand forever. But more terrorist attacks cannot be discounted even though the war seems to be going America's way as the Taliban abandoned one key bastion after another last week. And no one should have any illusions about a tidy end to the conflict. "If [ Osama bin Laden's] Al Qaeda gets hold of a nuclear bomb and gets it into Washington or New York or San Francisco," says Hale soberly, "you'll have a real clash of civilizations."So how, in a more frightening world, do you invest for your children's college fund and your own retirement? First, stop being flat-out scared. Adjust your mind-set to simple prudence. The world has changed, but it is not ending. "The global economy will eventually recover, and people will get used to a certain level of terrorism, like in the U.K. [under the constant threat of IRA bombings]," says Markus Rosgen of ING Barings in Hong Kong. "In the long term, terrorism is not going to be a major issue." True, companies will need to spend more on physical and I.T. security.Shipping and air travel expenses, supply-chain costs and insurance premiums are also rising. But these, by themselves, should not cause blowouts in corporate budgets. Since every firm is affected in one way or another, companies can pass on the additional expenditures to consumers without fear of getting undercut by competitors. The impact on bottom lines should be neutral in the long run as corporations and customers adjust to new pricing realities.What will almost certainly change is the way the markets value stocks. "The vast majority of investors today are fundamentally more cautious, less aggressive and therefore more likely to look at corporate fundamentals rather than chase Internet stocks that have no business models," observes Zurich Financial's Hale. The shares that will do well are those with good dividend yields, reasonable price-earnings ratios and substantial return on equity and assets. In other words, everything old is new again.The panic selling of the past two months has thrown up many of these gems. "Asia is the cheapest it has been in nearly 20 years," says Ajay Kapur, Asia strategist for Morgan Stanley in Hong Kong. "The U.S. is probably 20% undervalued, while Asia is about 50% undervalued." The region's economies, particularly Japan's, may be in tatters. "But investors have to separate economies from corporates," says Kapur. "While nominal economic activity is the worst in two decades, return on equity for Asian companies is higher than nominal growth. That hasn't happened in a long, long time."Analysts say some of the region's corporations are stronger today than they were before the Asian financial meltdown four years ago. "Since the 1997 crisis, companies have been doing good things to improve their infrastructure," says Mark Monson, head of fund management at Switzerland's Gottardo Asset Management. "Corporate Asia and central banks have focused on streamlining their operations and cutting off a lot of fat. Once external demand picks up, Asia's export-driven markets will rebound very quickly. I'm more confident about Asia now than I was before Sept. 11."What has not changed all that much are corporate governance practices. This has implications for Asia's long-term stock pickers, given the markets' back-to-basics orientation. "Definitely, the issue is being taken very seriously," says Robert Wylie, Asia Pacific head of consultant Deloitte Touche Tohmatsu's global strategic client program. "Companies with good corporate structures in place are much more likely to avert sharp downward movements in earnings. They have mechanisms that allow them to assess risk and predict the sources of risk looking forward."But by the same token, not all Asian blue chips that look cheap today are a good buy. The days when the markets automatically awarded premiums to politically connected but opaquely run family and state-controlled conglomerates are ending. "In times of excessive growth, many [corporate governance] shortcomings are covered up," says Alan Thompson, senior vice president at U.S. consultant Stern Stewart. "This crisis will unleash basic Darwinian forces. Global capital will flow only to companies that are transparent and which accord equal treatment to majority and minority shareholders."Many Asian conglomerates tend to pump large amounts of capital into their operations. They do generate earnings from every dollar, but the returns are often lower than the cost of capital. On the surface, both majority and minority owners take a hit. "But there are other ways for big shareholders to take returns," says Thompson. "They may sell the assets of their privately owned companies to the listed vehicle at inflated prices. They may pay themselves fat salaries and bonuses as managers and board members. They essentially turn gold into lead."Will they change? "We'll see a lot of corporate restructuring in Asia in the next two years," predicts Thompson. It's all part of investing and doing business in a world transformed by terrorism. In these pages, we reveal what well-known investors and celebrities in Asia would do with $100,000. You can pick up investment pointers and get insights into their thinking. Then read on — ASIAWEEK's investment picks start on page 41 — for other ideas on how to put your money to work in these interesting times.By ASSIF SHAMEEN/SINGAPORE, and MARIA CHENG andCHARLES S. LEE/HONG KONGhttp://www.asiaweek.com/